Although banks send out chequebooks automatically you can ask any of them not to send chequebooks to you until you request them. More than half of the £15.6m – £8.6m – is down to "forged cheque fraud", which covers chequebooks that go astray in the post. The amount lost to cheque fraud was £15.6m in the first six months of this year, although this is down on the £21.2m in the first six months of last year. HSBC will refund any customer who is a genuine victim of fraud." I rarely use my chequebook and didn't know another one was being sent," she says.Ī spokeswoman for HSBC said: "HSBC's standard practice is that we will automatically send out chequebooks to customers, unless they request we don't. "Obviously it is convenient to get your chequebook in the post but it seems odd there is no kind of security procedure to stop this kind of fraud. However, when she opened her post she was incensed to find another chequebook had been sent to replace the stolen one. Suzanne heard nothing more but checked her account on 29 October and found the money had been reimbursed. I received a generic letter on 20 October informing me the matter was under investigation and that HSBC would 'keep updated with progress', although it may take 'several weeks'."

#Hsbc uk cheque book update#

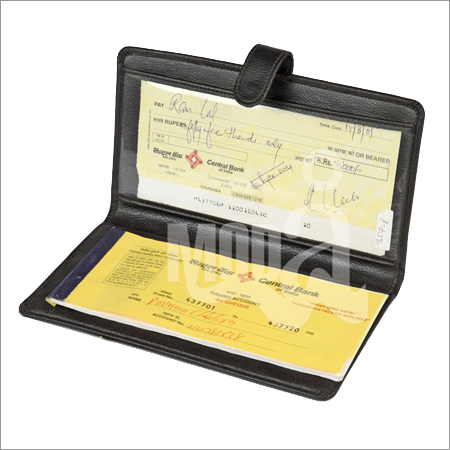

Three days later I had heard nothing, and so began a cycle in which I telephoned the bank and asked for an update and the person on the other end appeared to have no information whatsoever. She continues: "HSBC promised to raise an investigation into what was evidently cheque fraud and I was told it would get in touch within two working days. I found one large transaction that I didn't remember, a cheque paid out on 15 October to the tune of £920." I knew I hadn't spent anything like that much, so I started going through my bank statement online to find out what on earth had happened. "Just before going to bed on Monday 19 October, I checked my bank balance online and was surprised to see it was £700 overdrawn. "My general banking practices tend to be that I keep a mental tally (and often a written tally) of how much I ought to have in my bank account and then every week or so check that it matches up with how much I have. "I think of myself as quite careful with money," she says. I opted for the latter.Roll forward six years to October 2009 and 19-year-old Cambridge student and Cash reader Suzanne Burlton was shocked to find herself the victim of a similar scam, also losing £920 via a cheque from an HSBC chequebook she didn't know was in the post to her. The first was to deposit the cheque into your account, or you could complete an online form notifying HSBC of your current account and it'd cancel the cheque and pay the money straight into your account. "There were two ways you could get the money. It was then I saw on your website that I was not alone. The 62-year-old told : “I haven't had an account with HSBC for over seven years so getting a cheque for £50 out of the blue in December 2020 was a complete surprise.

One HSBC customer has received £394 in compensation from HSBC. Payments relate to HSBC, First Direct, M&S Bank and John Lewis Finance customers between 2010 and May 2019.Ĭustomers who have mortgages, overdrafts, credit cards or loans with these banks may be entitled to the arrears. Here's when London's Parkruns will start again.Morrisons, Sainbury's, Tesco and Waitrose shoppers distraught over 'drought' of customer favourite.has urged customers to not be alarmed if they get a cheque out of the blue. The banks are paying refunds worth £100s for interest and charges which should not have been due. HSBC, First Direct, M&S and John Lewis Finance are all paying customers who have been in arrears in the past few years.

Some Londoners will be blinking twice when they check their bank statements as banks are paying customers £100.

0 kommentar(er)

0 kommentar(er)